case studies

asset managementStrategic Asset Management of a Watermain Network

Background

- The client is a Canadian water utility that manages both a watermain and sanitary sewer network, using only revenue from a water fee.

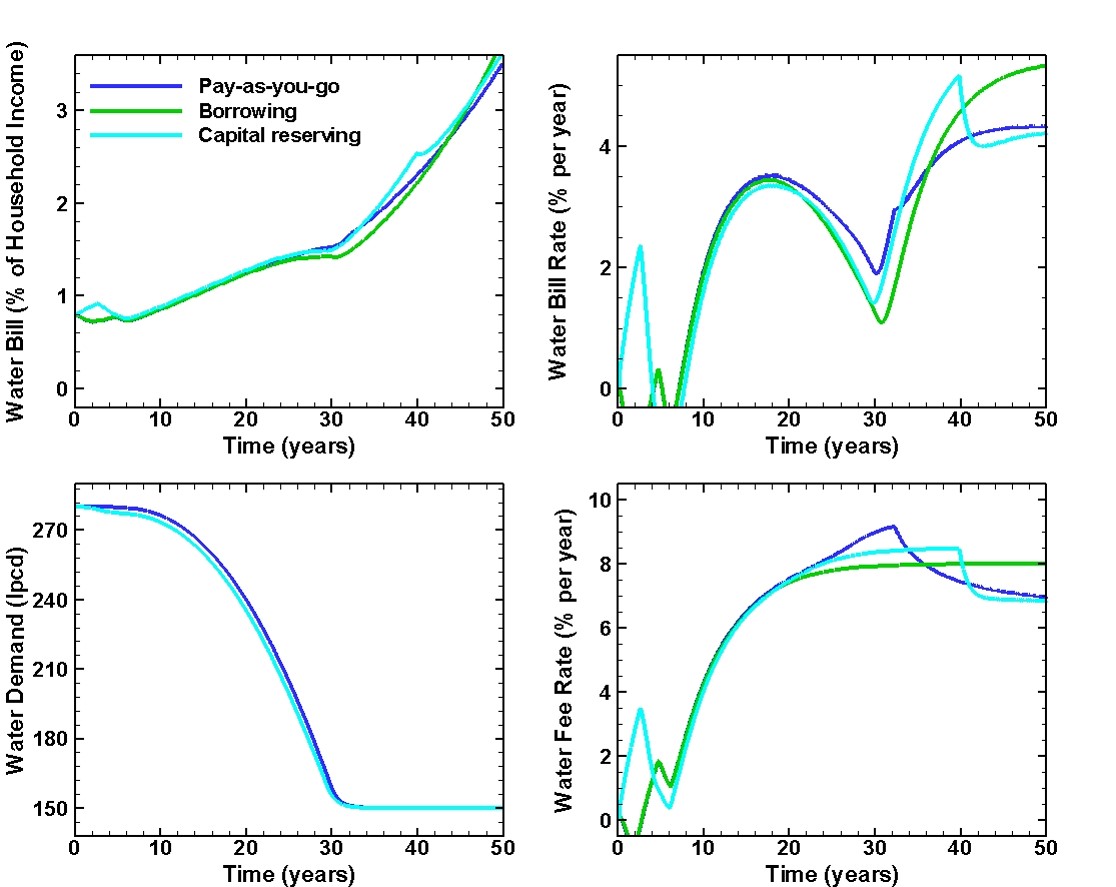

- The aim of the project was to help the utility rationalize to city council and regulators why it was necessary for them to increase the unit cost of water at a rate approaching 8% per annum. The utility also wanted to know its impact on water consumption and revenues.

- The utility wanted to develop pay-as-you-go, borrowing, or capital reserving financial strategies that would yield a least life-cycle cost for managing the system.

Approach & Scope of Work

- Appropriate strategic-level policy levers were developed to simulate the financial strategies.

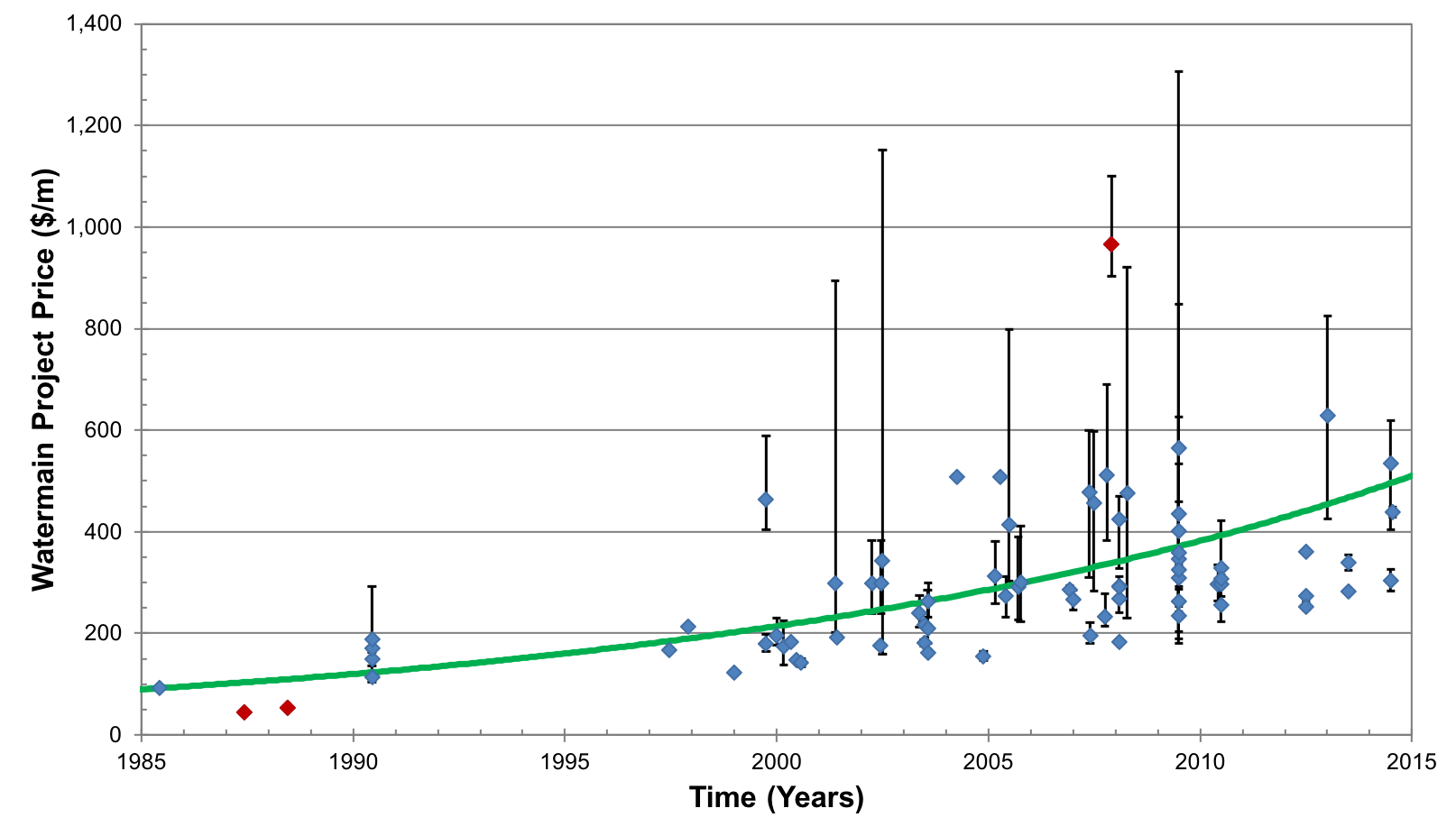

- A unit cost analysis was conducted on available tender-bid documents to assess inflation in capital expenses.

Outcome

- All three scenarios (pay-as-you-go, borrowing, and capital reserving) achieve the objective of no more than 5% of the network’s length being +75 years old over 100-year simulation period.

- All three scenarios have identical capital expenditures, although these expenditures are accomplished at different times in 100-year period.

- Capital reserving has lowest cumulative total expenses.

WaterIAM

“Water innovation on tap”

© 2018 WaterIAM

.net

VISIT US

442 Tamarack Drive

Waterloo ON N2L 4H1

CONTACT US

+1 519 581 8835

info@tempwateriam.watsems.com